Office: (443) 775-9600 | Fax: (443) 297-8111

Start Your Return

Specialized Management Service

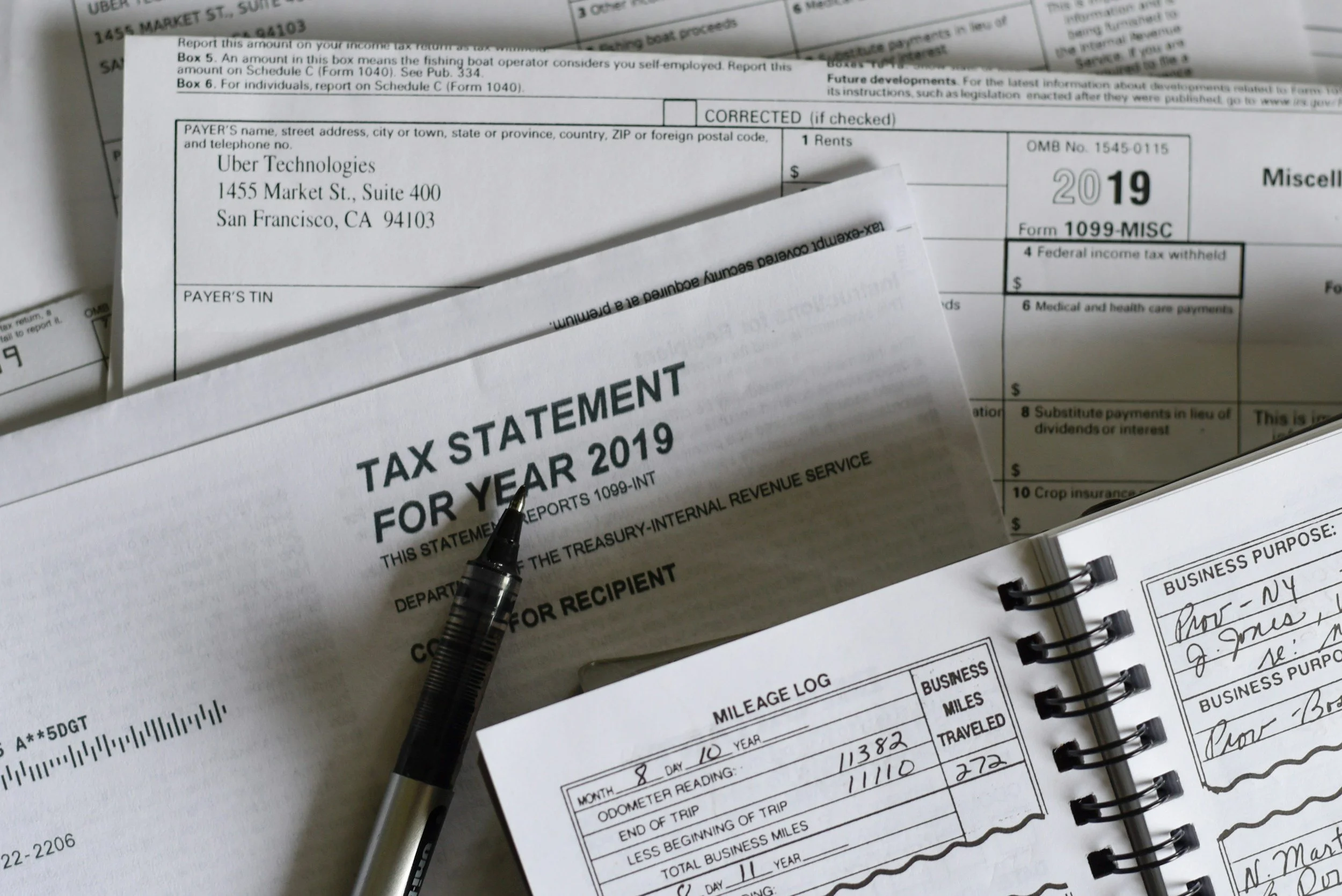

Easy, Accurate, & Virtual 1040 and

Schedule C tax preparation.

We help individuals, solopreneurs, and small businesses in Maryland with tax preparation & bookkeeping services. Whether you need your 1040 or Schedule C taxes prepared or help staying organized year-round we’ll make it simple & easy, virtually.

Why Choose Us for Tax Preparation?

Certified Tax Preparer with over 15 years of accounting & auditing experience

We provide easy and accurate tax preparation

Start Your Tax Return on our secure online website and upload your tax documents with ease

Our services are virtual, making it easy to complete the process from the convenience of your home

Pay for your tax preparation fee from your tax refund with our bank product options

Stress free filing with Protection Plus

Who Do We Work Best With?

We’re a great fit for tax preparation if…

You’re an individual who needs a 1040 completed

You’re a solopreneur or small business who needs a 1040 and Schedule C completed

If you are a business owner, you have a service based business

See Our Tax Preparation FAQs Below

Want To Get Started Early?

Schedule a free tax estimate.

If you have at least 90% of your tax documents you can schedule a free Tax Estimate. We’ll review your tax documents and estimate your tax amount and tax prep fees, before you file.

Tax Preparation estimate consults begin December 2025 - January 2026.

24hr Notice Required for Appointment Cancellation.

Tax Preparation FAQs

-

What is your process?

You may begin your tax preparation engagement by using the online website, setting up an account, and entering in your information. Then you can upload your tax documents.

Or you may schedule a consultation through my online calendar and we will meet via virtually (Teams or Zoom) to complete your tax return.

-

How can I speed up the process with my tax return?

In December & January we offer Estimate Tax consults. If you have all or 90% of your tax documents we can begin the process to estimate your tax amounts and the tax preparation fees. Once you have the remaining documents, upload them to your online account and notify my office. We will then begin completing your return.

-

Can you file my return electronically?

Yes, I e-file your federal and state tax returns securely once you’ve reviewed and approved them.

-

Do you offer tax planning or advice?

While I may offer general tax planning tips/suggestions after reviewing your tax return, my focus is on accurate preparation and filing. However, more complex planning may require a Tax Planning Service.

-

How do I pay for your tax preparation services?

Payment is due upon completion of your tax return. I accept various payment methods including credit cards and electronic transfers. You also have the option of using a bank product and pay for your tax preparation fee with your tax refund.

-

What happens after my tax return is filed?

Once your return is filed, I’ll send you a copy for your records along with confirmation that it was accepted by the IRS and state. Your documents will also be filed on our IRS approved portal for future reference.

Testimonials